E-Banking for Bank CIC

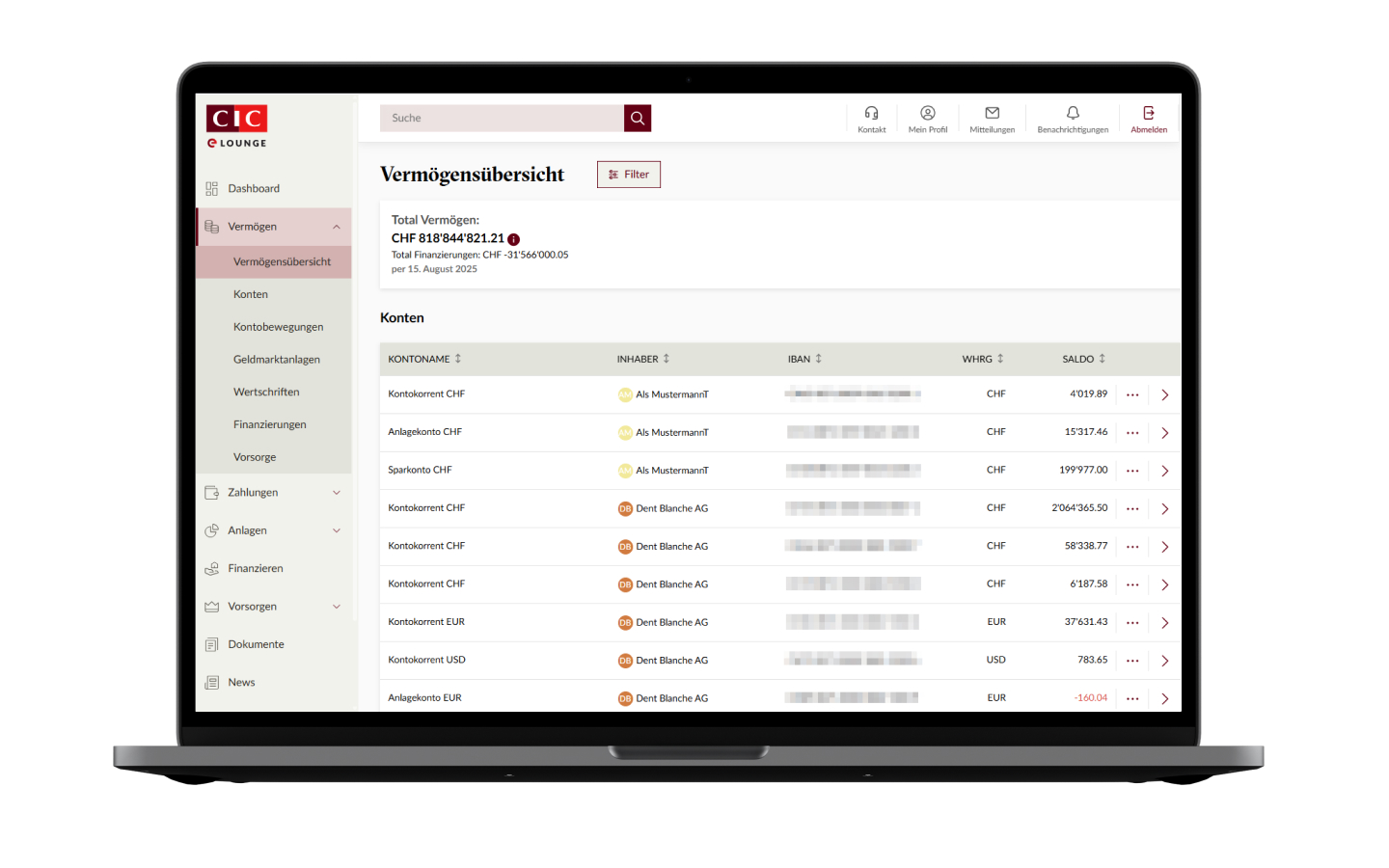

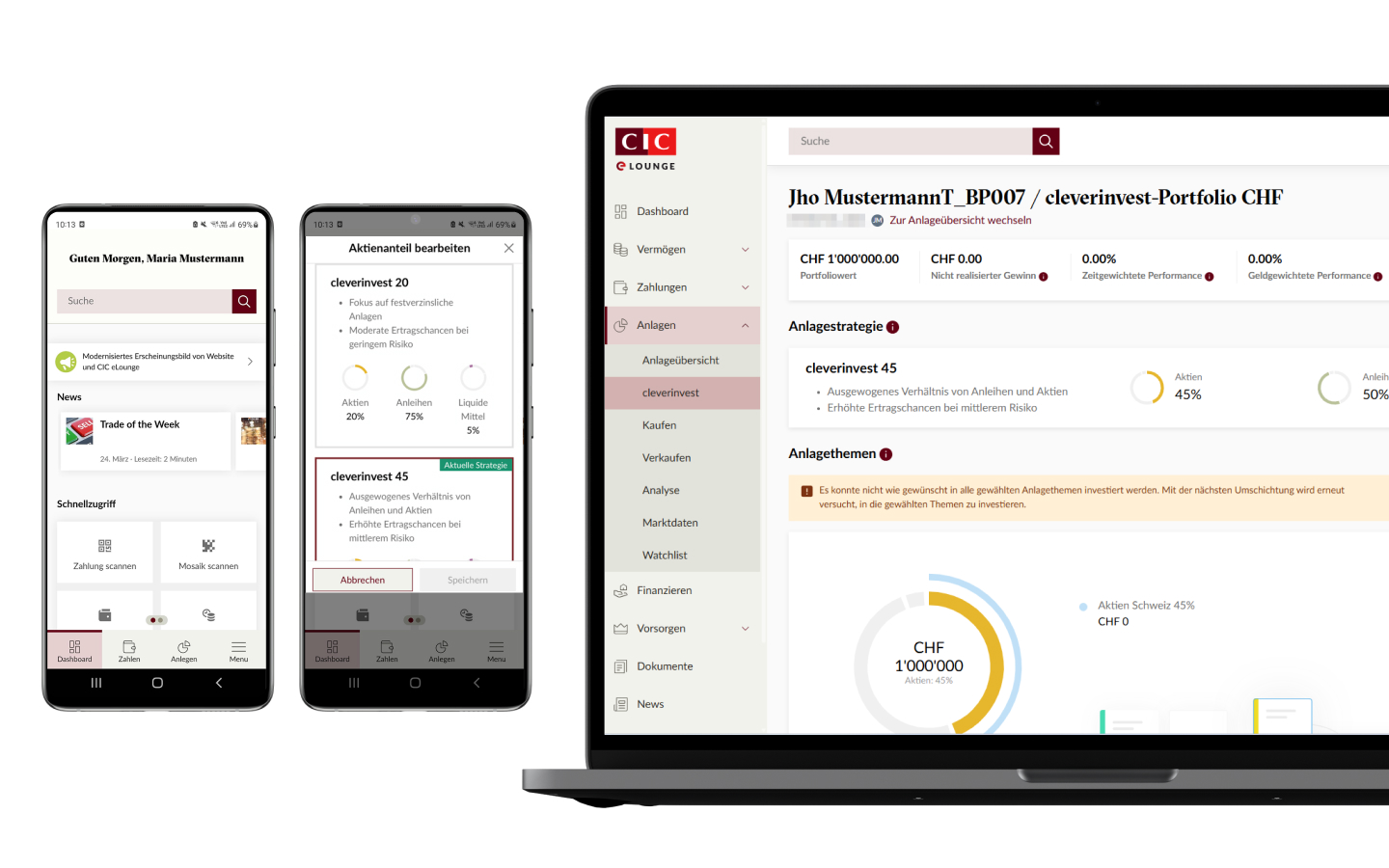

e-Lounge – The new, innovative mobile and e-banking service

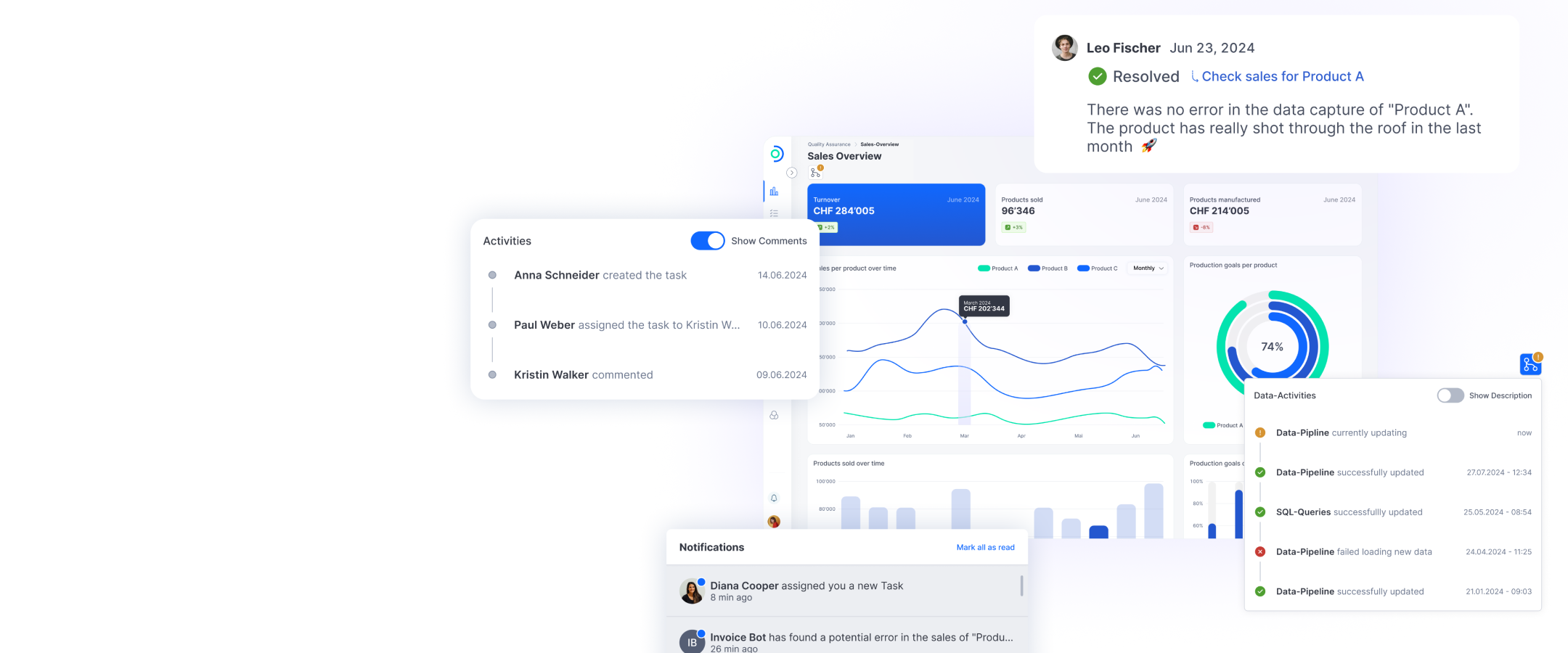

Bank CIC worked with us to completely redesign and develop its e-banking service for the Swiss market using our ti&m Banking product, gradually expanding it with new features.

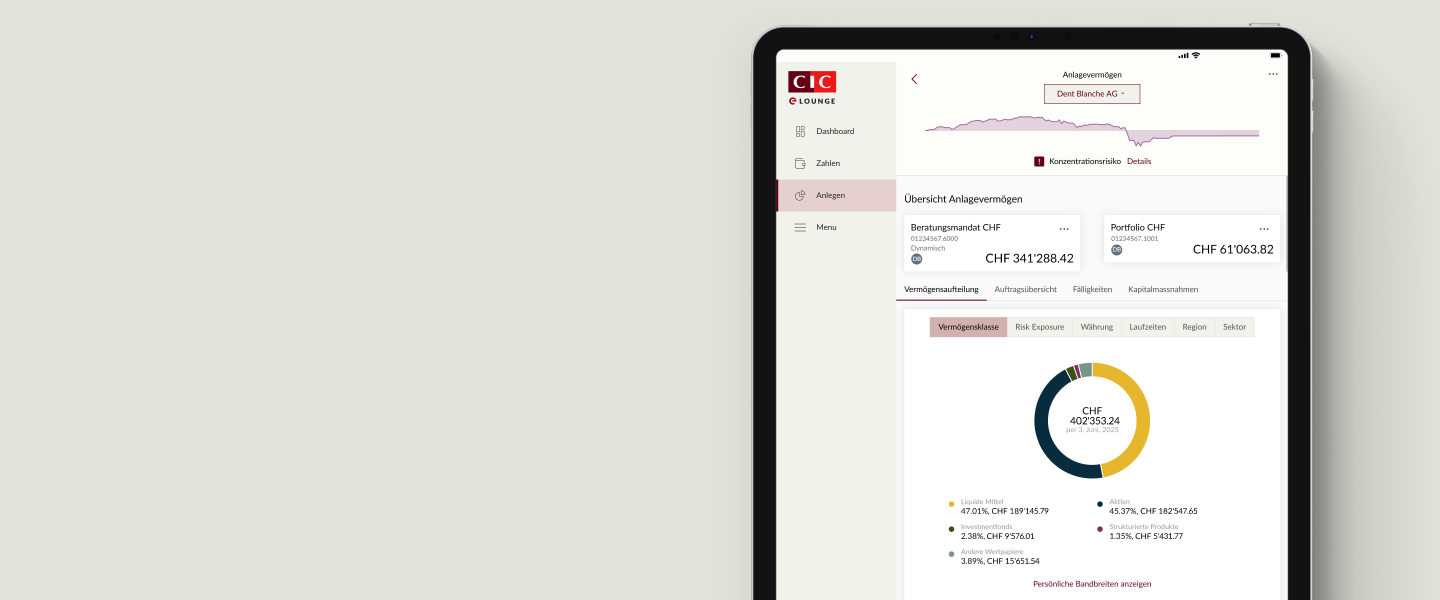

The new CIC e-Lounge offers customers a modern, comprehensive, and user-friendly digital banking experience with flexible and secure access via a web browser or mobile app. Customers benefit from a wide range of digital banking services, including opening new products and clear asset management. The intuitive user interface ensures seamless and efficient interaction.

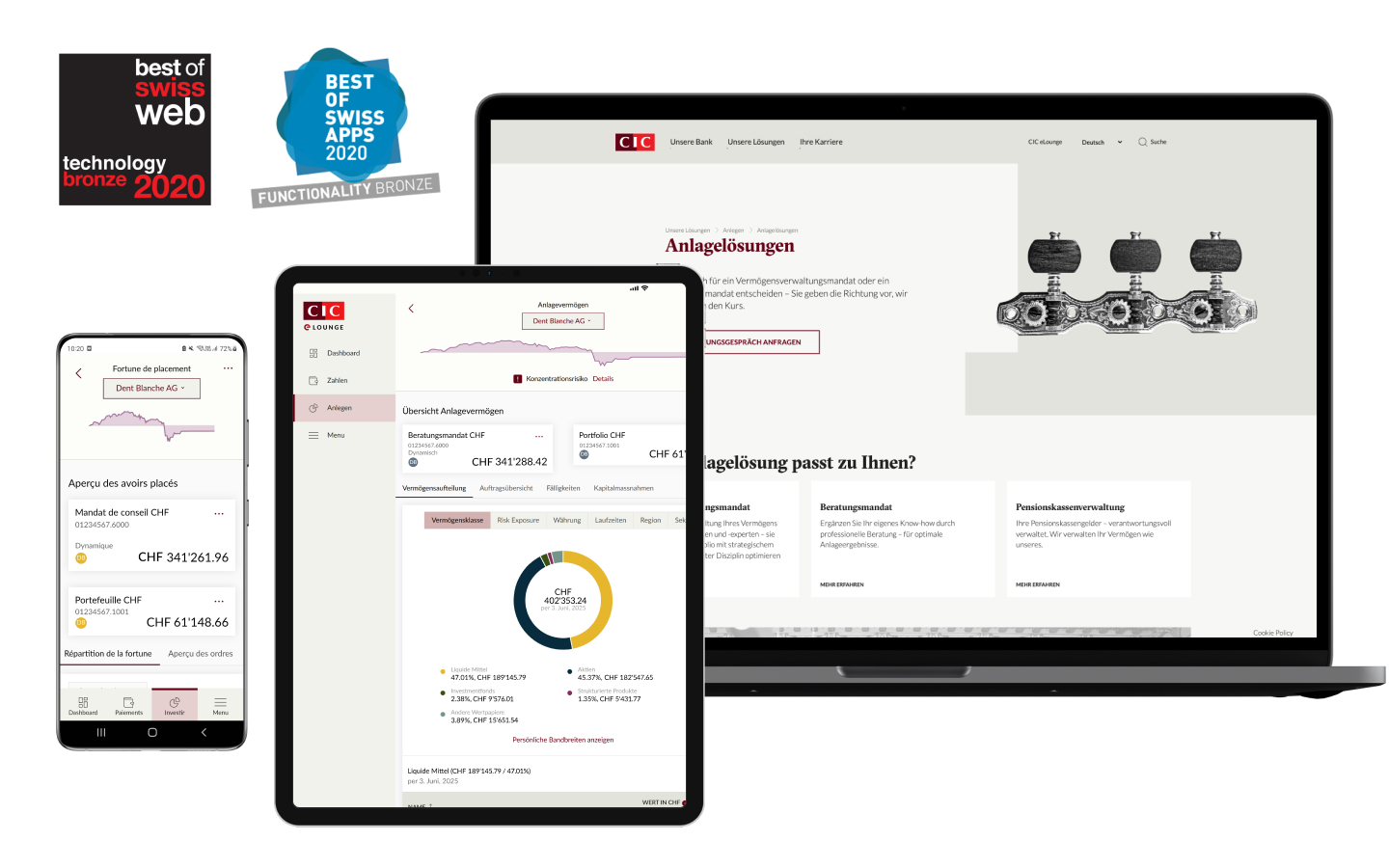

Best of Swiss Web and Best of Swiss Apps 2020 award-winner

Head Banking Innovations

Roger Zuberbühler

What questions do you have about the e-banking solution?