To the future and back: The customer journey in digital banking

Advice from a person or AI? Soon there may not be a difference. But how far down the road are we really? A look at the customer journey in digital banking shows how close – or far – we already are to this future.

Before we explore the customer journey in digital banking, let’s take a leap into the year 2060. Marc, 35, lives in a remote village in Graubünden and works as a freelance drone forester – a profession that didn’t exist 35 years ago. Fund savings plans, on the other hand, did.

When Marc wants to open a new savings plan, all it takes is a voice command to his banking app, which is connected to his AR glasses. An AI authenticates him via biometrics, analyses his finances, and suggests suitable fund options. The outcome? All done digitally in seconds. Marc’s investment is automatically optimized on an ongoing basis, returns are maximized, and he automatically receives personalized market updates.

However, should he feel the need to talk to someone face to face in the future, he can visit a phygital (physical-digital) branch at any time, where bank advisors work in tandem with digital assistants.

How realistic is this fictional future scenario really? And what does it mean for the digital banking of today?

Back to the past: Digital banking today

Digital technologies are already fundamentally changing the way banks and their customers interact. While neobanks and digital financial services providers are focused on creating a completely automated, mobile customer journey, smaller regional banks continue to play an important and unforgotten role, especially in Switzerland. Here, advisors often know their customers personally – and customers appreciate this personal, traditional form of contact. Will this change in the future?

How is AI evolving in digital banking?

Marc still has questions. He uses a voice command to start a video consultation with an AI bank advisor. Within minutes, this artificial – but incredibly human-like – intelligence answers his questions, shows him forecasts, and outlines options for optimizing his tax. The AI even has a face and makes its own facial expressions that unconsciously awaken feelings of familiarity in Marc. Personal human contact? Not relevant for Marc. He was born into a world with ChatGPT. And he has been raised with the idea that AI knows more than any human.

The leap between analog and digital in digital banking

As fanciful as this future scenario is, it is no longer beyond the realms of absurdity. Mobile banking already dominates our world as the most important channel for financial transactions – from making transfers and investment decisions to taking out digital contracts. But mobile banking is just one element of a comprehensive omnichannel strategy that enables customers to switch between different channels at any time without losing information. This includes intelligent chatbots and AI-powered assistants, which are already handling a large proportion of customer queries today.

The trend for an interlinked panoply of digital infrastructure geared towards customer needs seems set to continue. And customers expect fast, automated solutions to simple issues. But when it comes to complex decisions, the personal touch – as things stand today – remains crucial.

Automated decision-making processes and their role in the customer journey

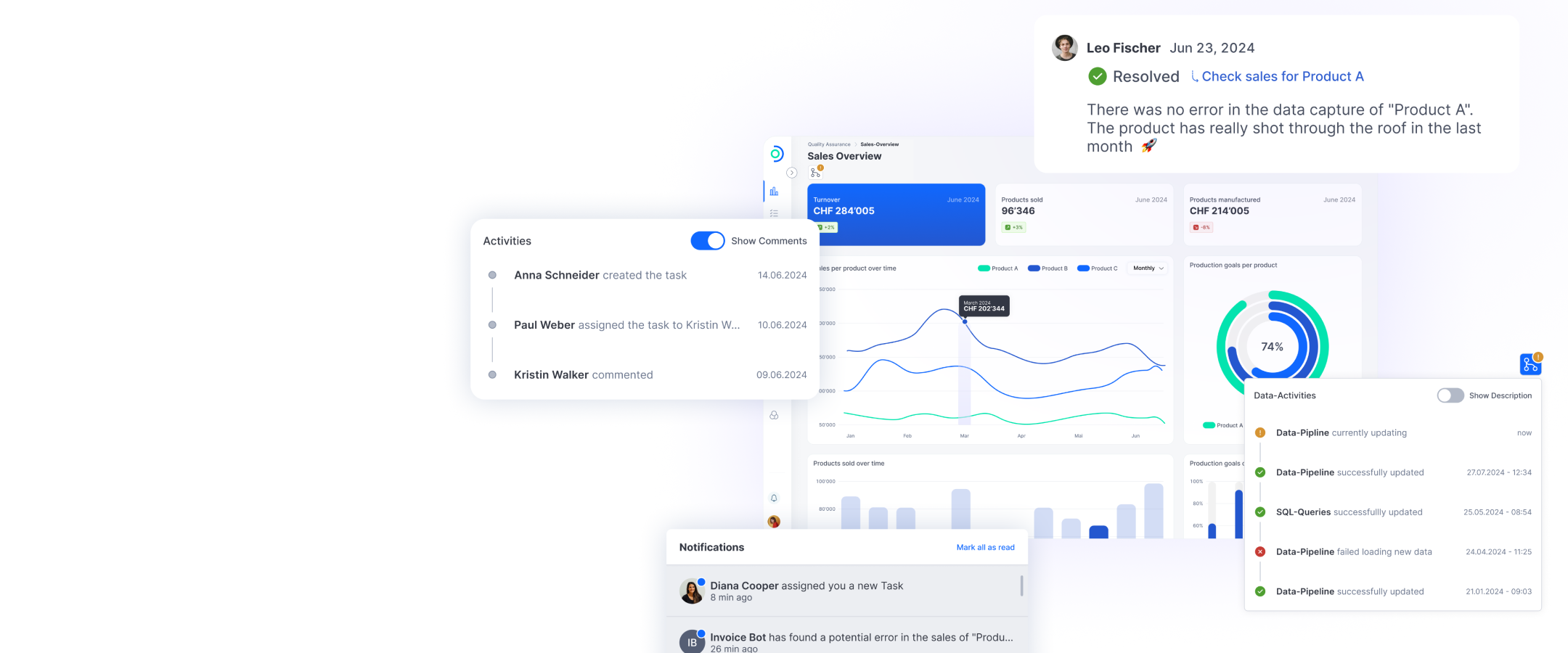

Automated systems are already pivotal in the customer journey of many banks. AI-powered algorithms make credit and investment decisions in seconds, analyze creditworthiness, check financial histories, and calculate risks with a precision that would be almost impossible for human advisors. While Marc’s AI advisor will act completely autonomously in the future, today’s customers still rely on a combination of human judgment and algorithmic support.

Data protection – savior of humanity in digital banking?

But where there is light, there is also shadow. The digital revolution in banking must grapple with data protection, fairness and transparency. While automated processes make financial transactions faster and more efficient, two key questions remain: How secure is our data? And who really makes the decisions?

Not everything can and should be controlled purely digitally or algorithmically. Customers are increasingly questioning the basis on which AI-powered systems calculate their financing, loans or investment proposals. Is an algorithm really objective? Or do data-driven models unconsciously reinforce existing biases and inequalities? These issues are not only a technological challenge for banks, but also a matter of customer trust and regulatory compliance.

The bottom line: The future of the customer journey in digital banking

Whether Marc in his time can overcome the hurdles of data protection and completely replace digital efficiency with human empathy remains to be seen. But the current trend still points towards hybrid solutions: AI makes the initial choice, humans have the final say. Personal interaction is often essential and valuable, especially when dealing with complex issues such as mortgages or long-term investments. The future of digital banking will likely involve an intelligent symbiosis of automation and personalized support, rather than the complete replacement of human advice.