“IT is the enabler for innovation, efficiency and growth”

Mr. Bernasconi, you have been CIO of Twint since August 2024. How has your first year been at Switzerland’s largest payment app?

My first year at Twint has been intense, exciting and enriching in many ways — which is hardly surprising given the dynamic market environment. Joining such an agile and fastgrowing company as CIO means you are right in the thick of things from day one. The team I joined is a well-established group of highly skilled IT management professionals who handle their operational responsibilities with great confidence and expertise. This made my transition into the company much easier.

What major IT projects and ideas has the company been working on since you joined?

Twint is growing dynamically in terms of both the number of transactions and the range of functions it offers. This places high demands on our IT. In addition to successfully implementing new functions such as the Business Portal app, the Express Checkout and the payment link, we have also begun a strategic overhaul of our IT platform. This will make our systems even more scalable, agile and robust. In turn, this will enable us to continue to meet the growing needs of our users with maximum reliability and performance in the future. In terms of IT, this means forward-looking architectural decisions, close collaboration with product management, and a clear focus on operational efficiency and quality.

How much AI does Twint already use today? And what role will AI play in the future?

For Twint, AI is not an end in itself, but a targeted tool for increasing efficiency and improving quality. We are currently developing appropriate solutions — particularly in the areas of test automation and support requests — and are continuously evaluating new potential applications. We are also testing AI-based approaches to fraud detection. Our focus is on the responsible and targeted use of AI, with a particular emphasis on stability, security and scalability.

“We are currently developing AI-supported solutions — for example in test automation and support — and evaluating the potential in areas such as fraud detection.”– Daniel Bernasconi

What are your long-term goals as CIO of Twint?

My goal is to position IT as a strategic enabler — a driving force for innovation, efficiency and growth. The Twint platform has to meet high standards and is constantly evolving to keep pace with growing transaction volumes, increasing availability requirements and a constant stream of new features. I see my role as actively helping to shape this path — driven by technology, but always in close collaboration with the business.

Twint is in the process of migrating to the cloud. What is the roadmap for this? How is the project progressing, and what challenges are there?

Migration to the cloud is a central component of our long-term IT strategy. The aim is to lay the foundations for even more efficient implementation of new products and features. The project is progressing according to plan — at the same time, we are aware of the high demands that come with a regulated environment and responsibility towards our partners and users. The biggest challenges are therefore not so much about the technology itself, but about regulatory issues. We take this responsibility very seriously.

On August 20, 2024, instant payment became mandatory in Switzerland. How has this affected Twint?

The introduction of instant payments has not changed much for our users — from their perspective, Twint payments are already processed in real time. Twint relies on existing banking interfaces that already deliver instant service to our users. We are therefore not directly connected to the new system at present. However, we are keeping a close eye on developments, so that we can identify any additional use cases that may be of interest to us. Our focus remains on providing a fast, secure payment experience that is widely integrated into everyday life — whether in online stores, when parking or with friends.

“When it comes to cloud migration, the biggest challenges are not technological, but regulatory issues.”– Daniel Bernasconi

At the beginning of the year, Twint announced that well over half of the Swiss population uses the payment app. Even more telling is the number of transactions, which has risen sharply: from 4 million in 2017 to 215 million in 2021 and 773 million in 2024. What percentage of these transactions took place in retail and how many between private individuals?

Around 75 percent of transactions via Twint take place in the retail sector, while payments between private individuals account for around 25 percent. This split reflects Twint’s broad range of applications — both for everyday shopping and for sending money to friends and family. Twint is becoming increasingly popular in both areas due to how easy, fast, and secure it is to use.

81 percent of physical stores and 84 percent of online stores already offer Twint as a payment method. That doesn’t leave much room for growth…

We are proud of this high level of penetration. However, it is not just the number of acceptance points and users that is driving Twint’s growth; the added value that encourages users to choose Twint every time they make a payment is also a key factor. Our focus therefore remains on innovation and the user experience. Even though we are already well established in many areas, new features and further developments of the app continue to offer scope for growth and broader use in even more everyday situations.

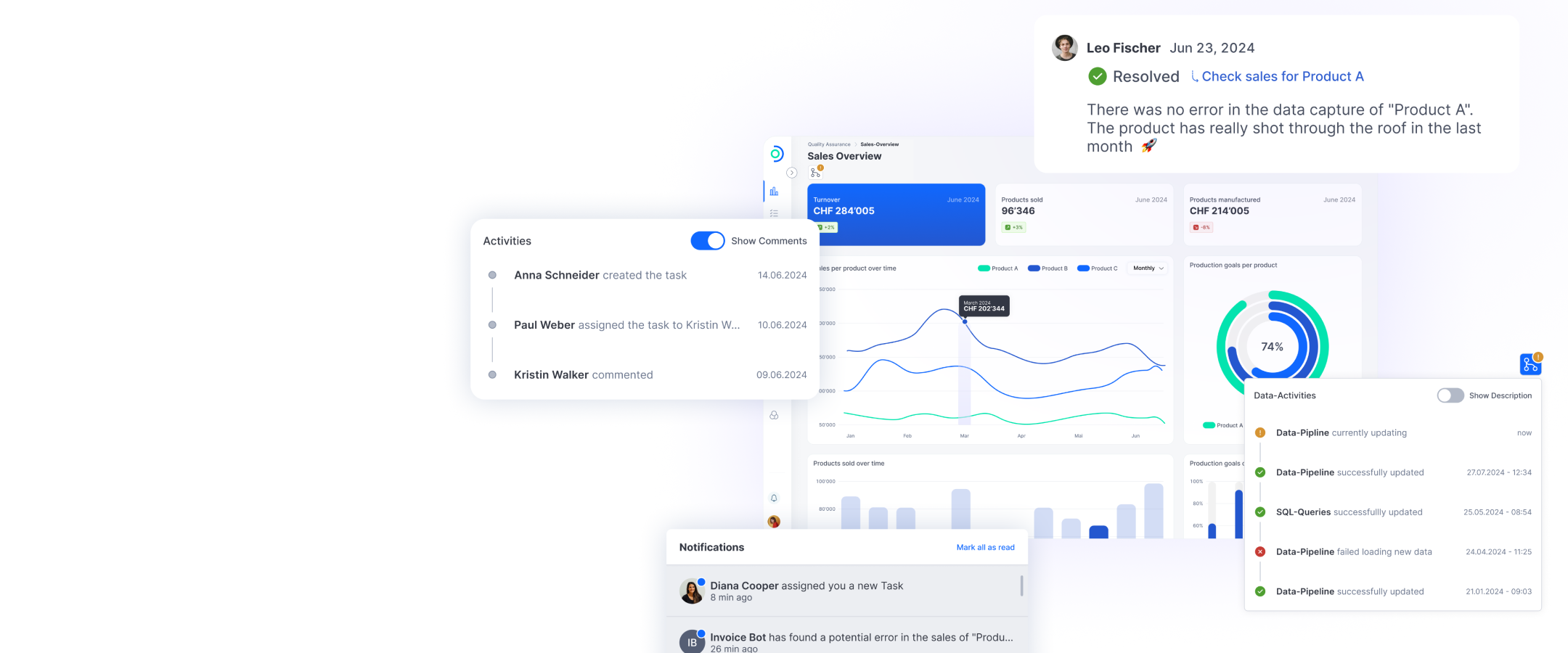

You earn money with payments in retail and launched three new offerings in this area this spring: the Business Portal app and a new app for merchants, as well as Express Checkout and the payment link. How do users benefit from these innovations and what has the feedback been like?

These new features offer merchants more efficient payment processing and even better integration into their business workflows. Express Checkout and the payment link make it even easier to process payments, while the Business Portal app enables merchants to keep clear track of their transactions. Feedback from the merchant community has been consistently positive — users appreciate the simplified processes and the increased flexibility.

How does Twint explore, evaluate and implement ideas for new features?

At Twint, we attach great importance to working closely with our users, merchants and banks. New ideas go through a structured process that begins comprehensive analysis of the market and ends with agile implementation. This way, we make sure that every new feature meets the needs of our users and offers real added value.

ti&m Special “Swiss software and AI 2025”