“The Swiss software industry is highly dynamic and resilient”

Swico takes the pulse of the industry every year in its Swiss Software Industry Survey. How do you assess the current situation and the innovative capacity of the Swiss software industry?

The annual SSIS Surveys and the Swico ICT Index show that the industry is growing strongly. The Swiss software industry is highly dynamic and is keeping pace with technological developments. It adapts innovations quickly and has so far proven to be very resilient in a difficult environment. It has weathered all the major crises of recent years — from the dotcom bubble and the financial crisis to the strong franc and COVID-19. In my view, this strength lies in the strong entrepreneurial spirit and the way in which companies have grown: Most of them began as start-ups, experienced significant growth, and are now well positioned in terms of organization. Another reason for the industry’s strong momentum is its customers. In Switzerland, customers have a strong appetite for innovation and demand this innovative strength from providers of customized software. The Swiss software industry deserves great praise for its dynamism.

In the 2024 survey, the forecasts for sales and employee growth were less optimistic than in previous years. What is troubling the Swiss software industry?

The software industry does not grow from within; it is dependent on the economy as a whole. And that is currently weak. Exports to Germany in particular have fallen sharply in recent months. Hopefully, the economy there will pick up again now there’s a new government. What we cannot yet accurately assess are the effects of global developments, namely Trump’s tariff and trade policy and geopolitical upheavals. Another point is that companies are increasingly turning to in-house solutions. They are building up their own skills and developing certain things themselves. As a result, software providers are receiving fewer orders.

How important are exports?

Overall, the export market is small and not a decisive factor for the Swiss software industry. Swiss manufacturers of standard software achieve just over 11 percent of their sales abroad, three quarters of which are in Germany. The figure is even lower for customized software. Still, exports rose by half a percent compared with the last survey, despite the relatively weak German economy.

What trends and developments do you see in the coming years?

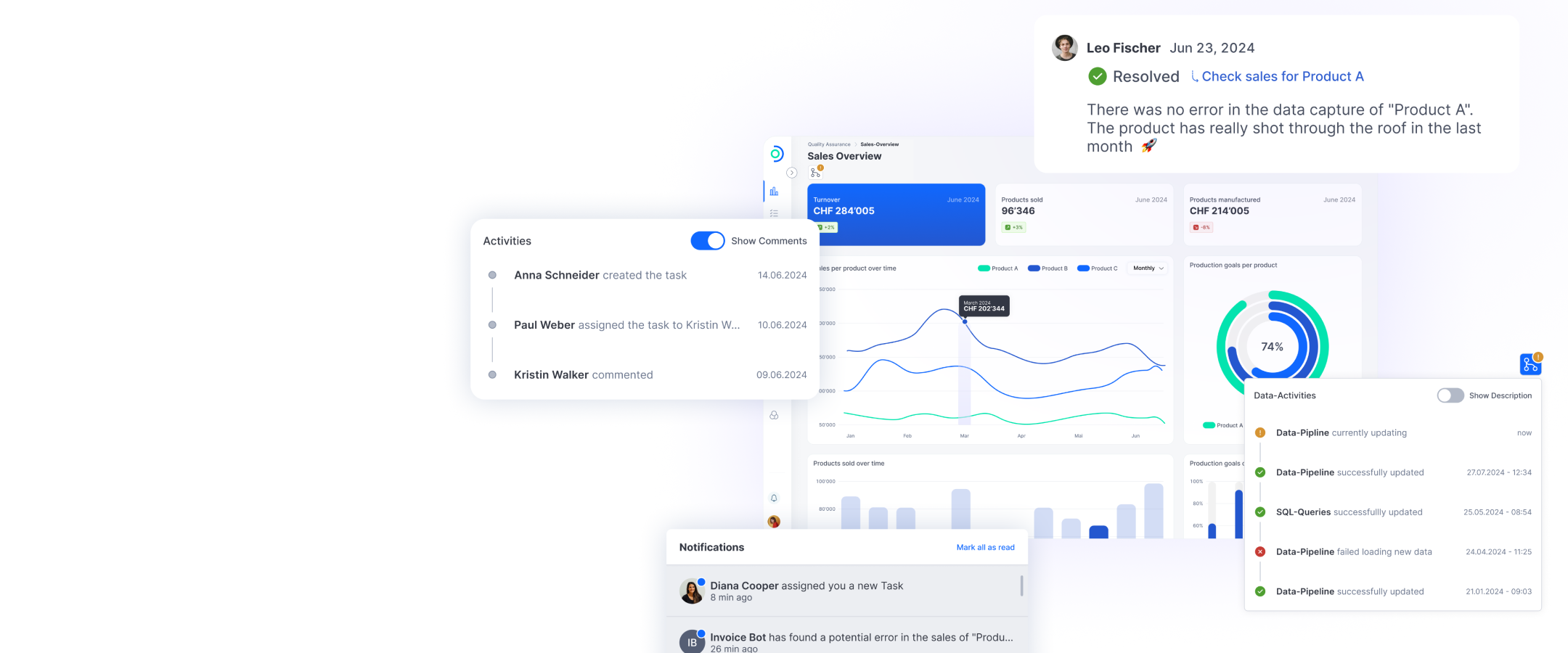

AI in all its facets will play a central role in the coming years. In particular, the use of generative AI and large language models at company level will increase significantly. This goes hand in hand with the need to clean up and consolidate databases: Structured, clean data remains the foundation for successful AI projects. It will be the task of our industry to support the economy in adapting quickly. Many of the legacy systems currently in use are still good, but many lifecycles will come to an end in the next few years. Sectors such as pharmaceuticals, insurance, and health insurance, as well as the federal government, will be among the largest customers for customized software. Other important topics will continue to be cloud migration and, in this context, the issue of digital sovereignty and the digitalization of administration.

How far has the industry itself come in adapting AI? How does Swico view the role of artificial intelligence in the industry?

AI will neither solve all the world’s problems nor drag us into the abyss. But it is fundamentally and rapidly changing our working world. Our industry, of course, is right at the heart of this. In the Swiss Software Industry Survey conducted in October 2024, we examined how far its integration into the routines, processes, and structures of Swiss software manufacturers has progressed. A few months ago, there was still a great deal of restraint in the industry. 58 percent of companies stated that they do not train AI with their own data. In addition, 86.2 percent of AI users have only introduced this technology in the last 18 months. AI is most widespread in software development itself (47 percent), followed by maintenance (41.5 percent), design (31.7 percent), testing (29.2 percent), and analysis (25.2 percent). There is room for improvement in terms of integration and planning: 44.8 percent and 43.1 percent of software companies respectively are not familiar with AI technologies in these areas of application. Personally, I think these figures would probably look a little different today.

And governance? How far along is the Swiss software industry with formal AI guidelines?

Swiss software companies tend to adopt a wait-and-see attitude in this regard. Informal governance practices are widespread, such as promoting exchange between departments or training employees, but formal practices such as clearly defined responsibilities are still relatively rare. Here, too, I can quote from the latest SSIS: One third ensure that AI use is in line with corporate objectives, 16.4 percent have guidelines or checklists for using AI, and 14.4 percent monitor the use of and access to AI.

Is this cautious approach to governance a problem? Do we need legislation?

The market will regulate itself: As soon as more orders come in, adaptation progresses, and AI governance becomes a unique selling point, software companies will respond.

Is Switzerland on the right track with the EU’s AI Act?

Swico supports the Federal Council’s current course, which is based on technology-neutral regulation and personal responsibility. We also support the ratification of the Council of Europe Framework Convention on AI, provided it is implemented pragmatically and with a sense of proportion. Innovation needs freedom. Clear rules are fine, but not excessive bureaucracy. Swico stands for a dynamic digital economy and Switzerland as a competitive business location.

Would stronger regulation be necessary in other areas — for example through a mandatory and transparent Software Bill of Materials (SBOM)?

An SBOM is essentially a detailed list of all the building blocks of a software application. It contains open-source software, libraries, frameworks, versions, and licenses — all the information needed to understand and manage the composition of a piece of software. I think that every company, as well as every government, must have control over its supply chain. But as a liberal person and as CEO of Swico, I am fundamentally skeptical about solving every problem with regulation. Clear and targeted rules are fine, but not unnecessary bureaucracy and regulation that brings no economic or social benefit.

How much is the industry feeling the pressure to cut costs? How is outsourcing developing?

When Swiss software companies outsource parts of their development, it is usually only a question of cost and no longer a question of a shortage of specialists. However, we do not have any specific figures on offshoring — the relocation of business processes abroad. Figures are available for outsourcing — in other words the transfer of processes to external service providers — and of course, these providers may also be located abroad: 56 percent use outsourcing, while 44 percent of Swiss software companies do everything inhouse. Where outsourcing takes place is strongly influenced by cultural factors: Europe is closer in terms of culture and time, while Asian countries are less common.

What role does research and development play in the Swiss software industry?

The picture here is mixed: Overall, the share of revenue invested in research and development fell from 5.9 percent in 2023 to 4.4 percent in 2024. Standard software manufacturers saw the sharpest decline in investment, while individual software manufacturers saw a slight increase. This reflects the different market conditions: While standard software providers are investing more cautiously due to the economic uncertainty, individual software developers continue to see growth opportunities in customized solutions.

In recent months, many countries have announced investments in AI worth billions, but not Switzerland. Are we falling behind?

Switzerland is generally well positioned as a location. The liberal economic order, which emphasizes personal responsibility, is a strength. We also have many bright minds and world-class universities that can also keep pace in the field of AI. I think Switzerland is therefore generally well positioned to benefit economically and socially from current developments. But this also means that we have to roll up our sleeves and not rest on our laurels. Other countries and regions of the world are not standing still and are catching up. That’s why it is important to stay on the ball and act intelligently. This means not pursuing a specific industrial policy, but creating innovation-friendly conditions and incentives to ensure that innovation translates into economic prosperity and social progress.

How dependent is Switzerland on big tech and what does this mean for the software industry?

Today, this dependency is global — even Switzerland cannot escape it. But this is not a one-sided phenomenon: Europe is a leader in various key technologies. Just think of 5G and 6G, drone technology, or the renewable energy sector. There have always been mutual dependencies, and these continue to exist today. That is the essence of the international division of labor. Although we are currently experiencing a phase of protectionism and tariffs, I believe in the market economy and open markets. I find we tend to think in terms of big tech vs. small software companies. That doesn’t get us anywhere. We need both: the big players — currently mostly US companies — and smaller companies. As Swico, we represent both categories, and that is one of the association’s strengths, not a weakness. As the Swiss association for the IT industry, we are committed to strengthening Switzerland as a business location and enabling it to compete internationally.

Swico is committed to sustainability in the software industry. What projects are you currently working on?

Many companies in our industry are certified according to standards such as ISO, the International Organization for Standardization, or EcoVadis. Naturally, companies also have a vested interest in ensuring energy efficiency and resource-saving software architecture. However, we emphasize that a sense of proportion is also important here — especially in the case of public sector tenders. It is important that sustainability issues are included in the requirements. In our view, however, it makes little sense to exclude companies that are not, or not yet, certified. This could well prevent the best possible solution from being found.

If you had three wishes for the Swiss software industry, what would they be?

Firstly, that the industry trains its own skilled workers even more than it has done in the past, working closely with educational institutions.

Secondly, that regulation follows the principle of not regulating specific technologies, but rather creating technology-neutral framework conditions.

And thirdly, that politics, society, and business support each other even better in order to achieve common goals. In Switzerland, there are no major government investments like in Germany or France. That’s why we need to work together to make even better use of our potential.

ti&m Special “Swiss software and AI 2025”